3rd ANNUAL SUBPRIME CREDIT FORUM

12-13 September 2019

Prague

Summary

The subprime lending has been a popular borrowing solution for a while now, and in 2019 plenty of people are applying for this type of credit. However, the issue of not having a lot of trustworthy and affordable credit options for lower income groups or people in need of urgent cash show similarities across the world. Furthermore, the shrinkage of loan markets, especially for high-risk borrowers in the aftermath of the 2008 financial crisis created new business opportunities for alternative/non-traditional lenders. Millions of people are still applying for these type of loans today, and the subprime industry once more is finding plentiful demand, as mainstream banks have tightened their loan criteria.

At the 3rd Annual Subprime Credit Forum, we will examine how these alternative platforms will influence the market as well as the traditional lending business models. The forum will focus on the operational and financial challenges of alternative lenders, and help them find practical solutions to the challenges that their companies are facing.

Day 1

Day 2

Speakers

Partners & Sponsors

Testimonials

“Very well organized. Great energy in the audience.”

— Vexcash, CEO, Germany

“Great people, outstanding business potential, relevant presentation themes.”

— Bondster Marketplace s.r.o, Relationship Manager, Czech Republic

“Interesting forum, very good organization.”

— Twino, Head of Group Credit Risk Management, Latvia

“I like that the attendees were mostly decision-maker level at their firms.”

— APFIN Ltd, UK

“Thank you for inviting me. It was a great experience and amazing opportunity to practice.”

— Group Head of Collection, Mash Group, Luxembourg

“Thanks for organizing a wonderful event and it is blessing and encouraging to know that there are people like your team on the other side of the earth constantly working with diligence and excellence for financial industry”.

— Manager, Investment Dept, CROWD CREDIT, Inc., Japan

Who Should Attend?

- Subprime lenders

- Consumer lending companies

- Short-term credit companies

- Fast credit companies

- Аlternative lending companies

- Payday loans originators

- Law firms / Consultants

- Credit Bureaus / Credit Scoring / Credit Data firms

- Software providers

- Fintech companies

- Collectors / Factoring companies

Why Should Experts Attend Our Event?

- Meet the world’s market-leading consumer & online lending companies

- Find practical solutions for challenges your organization is facing

- A unique platform to share know-how among consumer & short-term loan experts

- Listen to the best-practice examples and the lessons learned from the case studies

- Grow your professional network, and discuss potential collaborations with the industry peers

- Gain a competitive advantage in a rapidly changing business environment

- Influence and help shape future trends in the sector

Where and When?

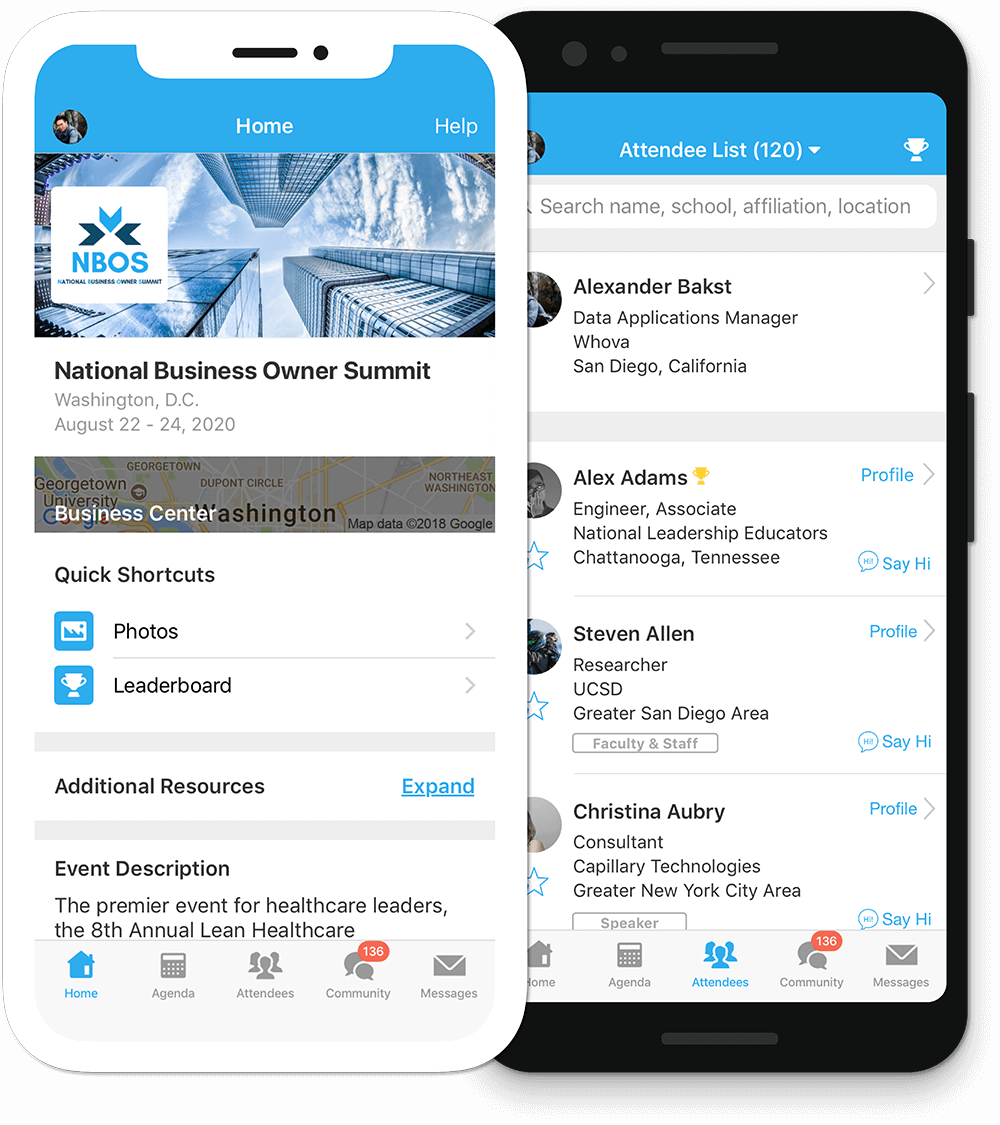

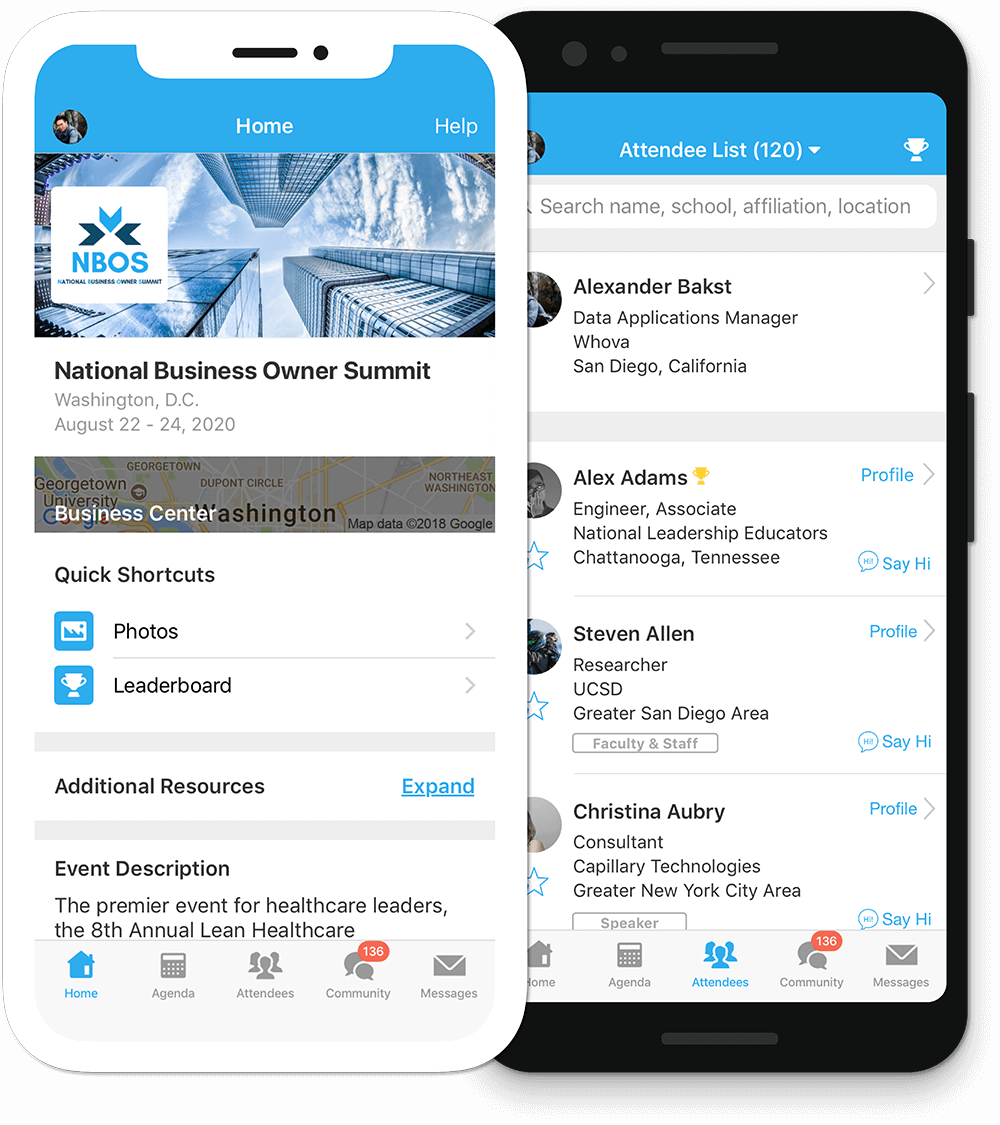

Get our official event app,

Get the most out of the app and have a more productive experience!

1

NAVIGATE the event agenda and logistics, even without Wi-Fi or data. Access useful information like ridesharing and local attractions through the Community Board

2

NETWORK effectively. Plan whom to meet by exploring attendee profiles and sending out messages

3

PARTICIPATE in event activities through session likes, comments, ratings, live polling, tweeting, and more

Travel Insurance

When you travel to a conference it’s important that you’re protected from the unexpected, that is why we are pleased to introduce you to Voyager Insurance as our appointed travel insurance partner for Uni Global delegates.

Voyager Insurance, established in 1996, are an award winning global provider of travel insurance for leisure and business travellers. They offer 5 star products and services, all backed by a 24/7 emergency medical helpline. They offer a range of travel insurances to fit travellers various needs and budgets – all available online. They can even provide cover if you have travelled in a hurry and forgotten to arrange cover before you left!

We are pleased to introduce them to you and you can get a quote for single trips or multi-trips from them by clicking here.